Sustainable energy investment is rapidly increasing, with $70.9 billion of new investment in 2006, which was 43% more than in 2005, and a similar continued growth trajectory so far in 2007. This is in response to a number of global challenges and concerns, including climate change, increasing energy demand and energy security. The investment community recognises the importance of the sector and the opportunities for value creation it presents. Consumers and companies are supporting the roll out of a new energy infrastructure and a change in individual and corporate behaviour. Most importantly, governments and policy makers are introducing legislation and support mechanisms to accelerate the development of sustainable energy investment .

This report presents the dollar view of the current status of Sustainable energy investment, including both the renewable energy (RE) and energy efficiency (EE) sectors. The analysis is based on the different types of capital flows and their movement over time, combined with regional and sectoral trends. The implications for all stakeholders of this rapidly evolving capital build-up are examined. The information is intended to provide financiers and policy makers with an overview of the status and drivers of the sustainable energy market development to help them weigh their commitments to the sector.

Key findings

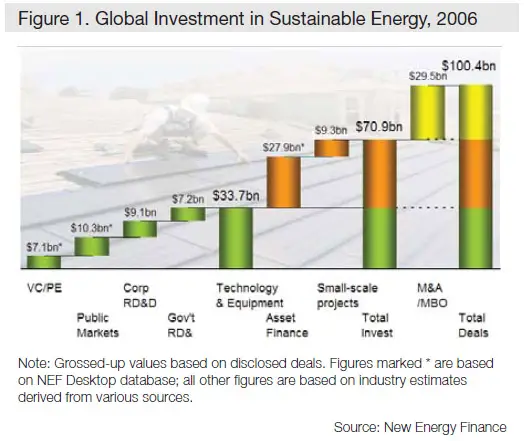

Sustainable energy investment was $70.9 billion in 2006 (Figure 1), an increase of 43% over 2005. The sectors with the highest levels of sustainable energy investment are wind, solar and biofuels, which reflects technology maturity, policy incentives and investor appetite. Levels of investment are similar between the United States and the European Union (27 Member States), with US companies receiving more technology and private investment, and EU-27 capturing the majority of publicly quoted companies. Sustainable energy investment in developing countries is increasing quickly, mostly in China, India and Brazil.

During the first quarter of 2007, the overall upward trend continued. A total of $2.2 billion of venture capital and private equity flowed into the sustainable energy sector, an increase of 58% over the same quarter in 2006. Listed stocks were up, with the NEX index (WilderHill New Energy Global Innovation Index) increasing 25% on the quarter, even though new public markets investment was down 18%.

Sustainable energy now accounts for a significantly larger share of generation investment than of installed capacity. Its share of generation will increase as technologies mature and as investment into expansion and technology feeds through into installed capacity.

Sustainable energy investment is still very much driven by policy, which today includes a broadening array of tariff and fiscal support regimes in many countries that together create a stable environment globally for continued sector growth. Investor appetite suggests that existing technology is ready for scale-up and that renewable energy can become a larger part of the energy mix without waiting for further technology development. Onshore wind is now an established commodity (while offshore wind continues to be difficult to finance).

Greening of industry and public awareness of climate change and other environmental issues are key drivers of renewable energy and energy efficiency.

The market has reached a critical mass, so that if oil prices drop to below $40, this will likely slow investment in some areas, but it will not stall it altogether.

Venture capital (VC) and private equity (PE) have increased significantly from $2.7 billion in 2005 to $7.1 billion in 2006, and look set to continue this growth in 2007. VC activity has moved up the maturity spectrum, with later funding rounds attracting most investment. There was noticeably higher investment in China during 2006, most of which was PE for solar manufacturing expansion. Biofuels, biomass & waste, solar and wind in roughly equal shares dominate private equity investment for expansion. In early 2007, all stages of venture capital and private equity investment saw increased activity, with later-stage leveraged private equity investments putting in a particularly strong showing.

Research and Development (R&D) increased to $16.3 billion in 2006, from $13 billion in 2005. EU-27 lags in new technology investment, which may be due to the comparatively low level of private sector involvement. Business funds 55% of R&D in the EU, as compared with 64% in the US and 75% in Japan. The number of incubators rose globally during 2006, as did the number of incubated renewable energy companies and successful transitions to the next stage of financing.

Public market activity surged in 2006, with $10.3 billion raised, which is more than double the $4.3 billion in 2005. Solar IPOs (initial public offerings) boosted 2006 volumes, raising just over $4 billion. The NEX index rose 31% during the year, which was well ahead of the stock market as a whole. The biofuels sector was the star performer. In early 2007, new listings slowed somewhat, with $1.8 billion raised in the first quarter, however, listed stocks continued to perform with a further 33% in the first quarter of 2007.

New asset financing in renewable energy generating plants in 2006 was $27.9 billion, an increase of 23% over 2005. Early indications in 2007 suggest that this pace is set to continue. Wind is the largest sector (followed by biofuels), however, shortages of key components (e.g. wind turbine gearboxes) have slowed down the rate of installation. New financing structures have emerged as an increasing number of traditional and innovative investors become attracted to RE, especially wind energy. Utilities with RE targets are building wind portfolios through acquisition, which is increasing overall price. The US is the leader, followed by Germany and Spain, and then China. Besides asset finance for generating plants, an additional $9.3 billion was invested in small-scale installations such as rooftop solar photovoltaics (PV) and solar water heating.

Mergers and Acquisitions (M&A) activity was up 34% in 2006, with deals valued at $16.9 billion. Most activity was in the wind sector – more than 40% of deals by value. Leading players in the renewable energy sector are taking strategic stakes. Increasingly, manufacturing companies are looking to vertical integration to secure supplies of key components. There is a trend towards companies in developing countries acquiring assets in OECD countries, suggesting a buy rather than build approach. Widespread availability of cheap capital is enabling this strategy.

Currently, $18 billion is under management in approximately 180 investment funds that are focused on sustainable energy. Both publicly quoted and private funds have seen high growth since 2005 (43% and 59%, respectively). Private funds are split across specialist and, more recently, generalist fund managers who have recognised the value – and profile – of sustainable energy investment. The challenge all funds face is the availability of high quality investments.

Carbon funds now total $11.8 billion, with the private sector providing most of the new money coming into the market. Growth of investment in the project development sell-side of the market shows that money is fl owing into the development and commercialisation of Clean Development Mechanism (CDM) and Joint Implementation (JI) projects. The net shortfall in project development activity is currently estimated at around $11 billion. Of the CDM projects currently in the pipeline (total 1,825), more than half (64%) relate to renewable energy (wind, geothermal, tidal, hydro, biomass or solar) and energy efficiency. These, however, represent only a fifth of the total Kyoto first commitment period credits.

Energy efficiency is a significant, but largely invisible market, which is now attracting an increasing share of the limelight as investors realise its role in addressing growing global energy demand. Investment in technologies was the most visible segment of the EE market: in 2006, $1.1 billion was invested in EE, compared with $710 million in 2005, which was due to strong support from multinationals and governments.

Capital has shifted to developing countries, which saw higher private investment in 2006.This reflects stronger Foreign Direct Investment (FDI), as well as private capital mobilising within emerging markets. China, India and Brazil are all now major producers of and markets for sustainable energy, with China leading in solar, India in wind and Brazil in biofuels. However, barriers to FDI remain, such as restrictions on foreign ownership in China, causing a prevalence of foreign-local joint ventures. Developing countries face the challenge of fast-growing energy demand combined with less mature capital markets (although this is improving) – which skews investment towards conventional, mostly fossil-fuel generation. Innovative work continues on designing financial instruments to encourage investment and manage risk in developing countries.

In conclusion, sustainable energy markets are becoming more liquid and more global. The various forms of capital now being deployed across the value chain signal the sector’s shift into the mainstream. Given the maturing sector fundamentals, the recent capital build-up does not appear to be a sign of short term volatility, but part of a longer-term trend. With individual sectors there is considerable volatility, however, risk and uncertainty can be diversified across technologies and geographies. These trends have continued through the first half of 2007, with new global sustainable energy investment expected to total $85 billion for the year. What these figures represent is not a fine-tuning of the current global energy system, but rather full-scale economic development. Investment growth is underpinned by clean energy policy initiatives. Despite the considerable discussion about the need for energy technologies of tomorrow, the investment community already believes that the technologies available today are ready to decarbonise the energy mix.

Source for this section on Sustainable Energy Investment : UNEP, Global Trends in Sustainable Energy Investment 2007,http://sefi.unep.org/fileadmin/media/sefi/docs/publications/SEFI_Investment_Report_2007.pdf