Peak Oil: World production of conventional oil will reach a maximum and decline thereafter. That maximum is called the peak. Peak Oil refers to the rate of global oil production as it changes from the previous increasing trend to the unavoidable downtrend as the world’s oil fields start their overall decline phase.

As oil stocks and reserves dwindle, there will be less available each year in future than there has been in the past. Many of the world’s major oil regions are already in decline. The North Sea, Alaska, Kuwait’s Burgan and Mexico’s Cantarell super giant fields are all now in clear decline.

“Scientists who warned us for ages about climate change were ignored and derided. Now, droughts, hotter temperatures and melting glaciers are showing the warnings should have been heeded earlier and action taken. Other scientists have warned us about Peak Oil for years, and they have been similarly dismissed, probably just as unwisely.” (Bruce Robinson, Convenor of the Australian Association for the Study of Peak Oil & Gas)

Oil well in Texas

Walter Youngquist, an emeritus member of the American Association of Petroleum Geologists, issues a warning about depleting oil resources. “When the future of oil is discussed, the common question asked is: How long will oil last? This is the wrong question. The critical date is when the peak of oil production is reached and the world’s demands can no longer be supplied.”

The assessment of the world’s oil endowment is a sensitive subject with political implications and many vested interests. However, oil production has exceeded new oil discoveries for more than thirty years. There’s still plenty of oil to be found, but it is no longer cheap. Finding oil in hostile environments or substituting heavy or high-sulphur oil is not the same as the discoveries by Humble Oil in Texas ninety years ago. In those heydays the companies drilled a few feet to get light, sweet crude oil.

Nowadays, companies are spending many years to build billions of dollars worth of rig. Then they drill thousands of feet in the ocean, and thousands more into rock. This does not make for cheap oil. The record-setting Chevron well, called Jack 2, which is 175 miles off the Louisiana coast, is more than five miles deep, including more than a mile of ocean depth.

ExxonMobil’s Beryl Alpha, located in the North Sea.

This does not mean that oil will simply “run out”. Oil will most likely be found at deeper and deeper depths with more impurities, costing more to locate, drill, extract and process. According to Matt Savinar, “The issue is not one of “running out” so much as it is not having enough to keep our economy running.

In this regard, the ramifications of Peak Oil for our civilization are similar to the ramifications of dehydration for the human body. The human body is 70 percent water. The body of a 200 pound man thus holds 140 pounds of water. Because water is so crucial to everything the human body does, the man doesn’t need to lose all 140 pounds of water weight before collapsing due to dehydration. A loss of as little as 10-15 pounds of water may be enough to kill him.

In a similar sense, an oil-based economy such as ours doesn’t need to deplete its entire reserve of oil before it begins to collapse. A shortfall between demand and supply as little as 10-15 percent is enough to wholly shatter an oil-dependent economy and reduce its citizenry to poverty.

The billionaire oil investor T. Boone Pickens said on Tuesday 18 June 2008, that world crude oil production has topped out at 85 million barrels per day even as demand keeps climbing, helping to drive a the surge in prices. Pickens, who heads BP Capital hedge fund with more than US$4 billion under management, said during testimony to the Senate Energy and Natural Resources Committee, “I do believe you have peaked out at 85 million barrels a day globally,”.

The United States alone has been using 21 million barrels of the 85 million and producing about 7 of the 21, and the demand is about 86.4 million barrels a day.

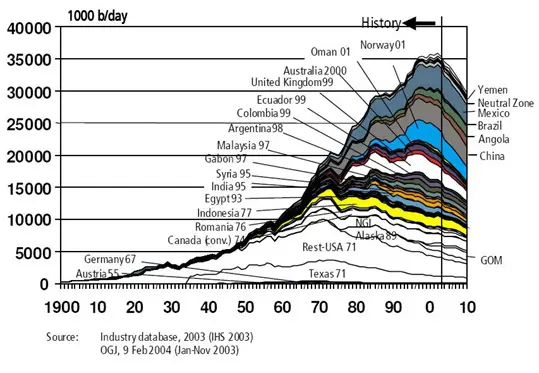

This graph shows that oil production has already peaked in non-OPEC, non-former Soviet Union countries.

There are substitutes for cheap oil, but none of them currently stack up against oil in terms of economics. Biodiesel, ethanol and tar sands all require significant energy to produce, and some consume more energy than they yield. Petroleum will still be produced a century from now, but it will only be a tiny fraction of today’s yield. Some think that technology will save the day, but there is an element of wishful thinking. Energy is not the same as technology, and technology does not substitute energy. In fact, cheap energy makes technology possible, not the other way around.

We must invest BIG TIME in renewable energy. It is only when these technologies are developed and deployed at a large scale globally that costs will come down.

“The rapid rise in oil prices, energy dependence and its economic consequences has again become a big issue. One form of energy insecurity, however, should not disguise the other and more fundamental insecurity associated with climate change. Emissions continue to rise and the immediate effect of high oil prices is to increase the consumption of coal on the grounds of cost and availability. That is already happening. Equally dangerous is the risk that the focus on prices will halt the momentum of the progress which is being made towards a global agreement to limit and reduce emissions and to keep the level of carbon in the earth’s atmosphere within the margin of safety.”1

1 Professor Michael Grubb, Chair, Climate Strategies and Chief Economist, 2008, The Carbon Trust Energy and Climate: Opportunities for the G-8 Research by Climate Strategies,Prepared for Cambridge Centre for Energy Studies, http://www.climate-strategies.org/uploads/ClimateStrategiesG8report.pdf